Financial crisis in the U.S. Housing market: Difference between revisions

From Santa Fe Institute Events Wiki

No edit summary |

No edit summary |

||

| Line 1: | Line 1: | ||

=== Project: === | |||

Credit-network model of the U.S. Housing market | Credit-network model of the U.S. Housing market | ||

=== Objective: === | |||

To develop a model that explores the salient dynamics of the real estate credit crisis in the US. | To develop a model that explores the salient dynamics of the real estate credit crisis in the US. | ||

=== Motivation: === | |||

[[image:US house prices 2008.gif]] | [[image:US house prices 2008.gif]] | ||

=== Approach: === | |||

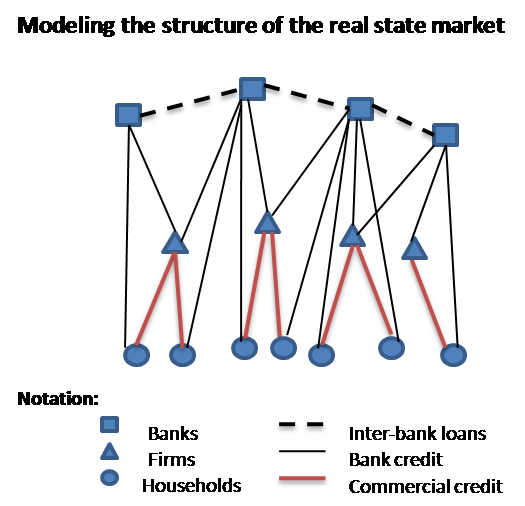

A three- sector model of heterogeneous interacting agents (HIA) consisting of a credit-network of banks, firms and households. | A three- sector model of heterogeneous interacting agents (HIA) consisting of a credit-network of banks, firms and households. | ||

=== Credit-Network Structure: === | |||

[[image:Mortatge credit structure.png]] | [[image:Mortatge credit structure.png]] | ||

=== Resources === | |||

This American Life did a radio piece on this very recently [http://www.thisamericanlife.org/Radio_Episode.aspx?episode=355 show link] | |||

Revision as of 13:54, 14 June 2008

Project:

Credit-network model of the U.S. Housing market

Objective:

To develop a model that explores the salient dynamics of the real estate credit crisis in the US.

Motivation:

Approach:

A three- sector model of heterogeneous interacting agents (HIA) consisting of a credit-network of banks, firms and households.

Credit-Network Structure:

Resources

This American Life did a radio piece on this very recently show link